Clean Energy Stocks

In an era where sustainability is not just a choice but a necessity, the clean energy sector emerges as a beacon of innovation and opportunity.

This pivotal shift towards renewable resources offers a dual advantage: addressing the global climate crisis and presenting a burgeoning avenue for investors.

As the demand for sustainable energy solutions grows, companies leading the charge in renewable technologies are gaining traction in the global market.

This article delves into the contributions and potentials of notable players in the clean energy landscape, highlighting their innovations, market impacts, and what they offer to investors seeking green alternatives.

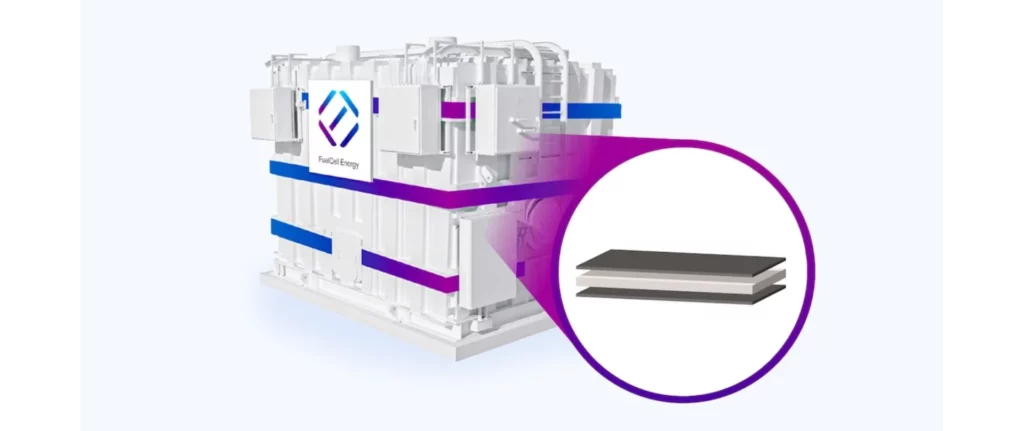

FuelCell Energy: Pioneering the Frontier of Clean Energy Solutions

FuelCell Energy stands out in the renewable energy sector, showcasing remarkable innovation and versatility.

This company is not only a provider of comprehensive solar energy services but also a pioneer in the development of hydrogen fuel cells. These technologies are at the forefront of transforming how we store and distribute energy.

Here’s a closer look at what sets FuelCell Energy apart:

- Diverse Energy Solutions:

- Solar Panel Installations: Expertise in deploying solar solutions across various settings, enhancing renewable energy accessibility.

- Wind Turbines: Contribution to the wind energy sector with efficient and reliable turbine solutions.

- Hydrogen Fuel Cells: Innovating in fuel cell technology, offering sustainable alternatives for energy storage and distribution.

- Growth Potential in Niche Markets: FuelCell Energy is recognized for its strategic focus on niche markets within the renewable energy domain, providing specialized products and services that cater to specific industrial needs.

- Commitment to Sustainability:

- Industrial Applications: Offering cutting-edge fuel cell technology tailored for industrial use, demonstrating a strong commitment to sustainable energy solutions.

- Leadership in Clean Energy: Positioned as a leader in the clean energy transition, FuelCell Energy is dedicated to pushing the boundaries of what's possible in renewable energy, setting new standards for innovation and environmental responsibility.

FuelCell Energy’s comprehensive approach to clean energy solutions, spanning from solar power to hydrogen fuel cells, exemplifies its commitment to advancing the renewable energy sector.

The company’s focus on innovation, versatility, and sustainability positions it as a key player in driving the transition towards a cleaner future.

For investors eyeing growth opportunities in the renewable energy space, FuelCell Energy offers a compelling portfolio that aligns with the global shift toward sustainable development.

Canadian Solar: A Global Powerhouse in Solar Innovation

Since its inception in 2006, Canadian Solar has consistently pushed the boundaries of solar technology, achieving a prominent position on the NASDAQ within the same year of its founding.

The company's dedication to quality and innovation is evident in its state-of-the-art testing laboratory, which ensures its products adhere to the highest standards of reliability and safety.

With a forecasted increase in battery storage shipments and numerous projects under development, Canadian Solar's trajectory is marked by strategic growth and technological advancement.

The introduction of the HiKu and Ku series panels, alongside the development of high-capacity commercial panels, showcases Canadian Solar's commitment to efficiency and sustainability.

As a global leader in solar module provision and solar plant development, the company's expansive reach and comprehensive research efforts underscore its pivotal role in the renewable energy revolution.

NextEra Energy: Powering the Future with Renewable Energy

NextEra Energy stands tall as a colossus in the renewable energy sector, with its market capitalization mirroring its immense impact and leadership.

The company's unwavering dedication to generating zero-carbon electricity positions it as a beacon of progress and sustainability within the industry.

Below are the pivotal elements that define NextEra Energy's journey and its commitment to a greener tomorrow:

- Market Leadership:

- Renewable Energy Giant: A leading force in the renewable energy sector, reflecting through its significant market cap.

- Zero-Carbon Electricity: Committed to producing electricity with minimal carbon footprint, leading the way in environmental stewardship.

- Investment Highlights:

- Exceptional Shareholder Returns: A history of delivering outstanding returns to shareholders, showcasing its financial robustness.

- Strategic Energy Mix: Focus on wind and solar energy, further enhanced by innovative battery storage solutions, outlines a future-proof energy strategy.

- Innovation and Sustainability:

- Battery Storage Innovations: Pioneering in the field of energy storage, offering solutions that enhance the reliability and efficiency of renewable energy.

- Sustainable Vision: A clear and ambitious roadmap for expanding its renewable energy portfolio, demonstrating leadership in the transition towards a sustainable energy landscape.

- Challenges and Strategies:

- Political Lobbying: While facing scrutiny over its lobbying efforts, NextEra Energy actively engages in shaping energy policies to support renewable development.

- Acquisition Strategies: Despite challenges in acquisition endeavors, the company’s strategic investments underscore its commitment to growth and leadership in clean energy.

NextEra Energy's blend of environmental commitment and strategic financial performance offers investors an attractive proposition.

By leading the charge in renewable energy innovation, particularly in wind, solar, and storage technologies, NextEra not only champions a sustainable future but also presents a robust investment opportunity in the green economy.

Its proactive approach to overcoming industry challenges and capitalizing on growth opportunities further cements its position as a powerhouse in the renewable energy domain.

Renewable Energy Group: Transforming the Biofuel Sector

The strategic acquisition of Renewable Energy Group by Chevron Corp. underscores the increasing significance of biofuels in the global energy mix.

This landmark deal not only highlights the oil industry's shift towards cleaner energy sources but also the Renewable Energy Group's influential role in advancing biofuel technologies.

As the world intensifies its efforts to reduce carbon emissions, the company's innovative projects and experienced management team are at the vanguard of developing renewable energy solutions that can significantly impact climate change mitigation efforts.

The Integral Role of Renewable Energy Certificates (RECs)

Renewable Energy Certificates (RECs) play a vital role in the economics of renewable energy, serving as a tangible representation of the environmental benefits generated by clean electricity.

These certificates support the growth of renewable energy by providing a financial incentive for producers and offering a mechanism for consumers and businesses to contribute to the expansion of green power.

By understanding and participating in the REC market, investors and companies can actively promote the development of renewable energy projects, furthering the transition to a sustainable energy future.

Conclusion

The journey towards a sustainable future is paved with innovation, strategic investment, and a commitment to environmental stewardship.

Companies like FuelCell Energy, Canadian Solar, NextEra Energy, and the Renewable Energy Group, along with the strategic use of Renewable Energy Certificates, are leading the way in transforming our energy systems.

For investors, engaging with the clean energy sector offers a unique opportunity to contribute to global sustainability efforts while pursuing financial growth.

As we navigate the challenges and opportunities of the renewable energy landscape, the role of informed investment in driving progress cannot be overstated.

Embracing clean energy stocks is not just an investment in the future of our planet—it's a stake in the future of energy itself.

Source: